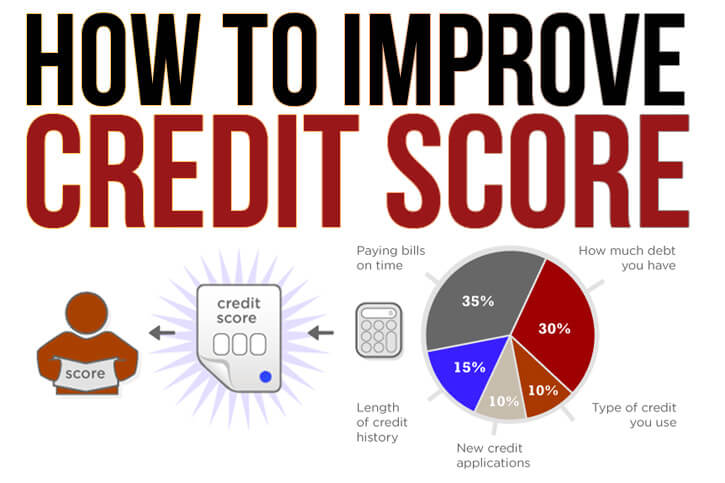

5 Smart Tips to Improve Your Credit Score for Loan: When you apply for any loan, your credit score is the first major thing your bank will look at. You may easily meet many of your life goals with a high CIBIL score especially when you need a loan from the bank. On the other hand, a low credit score might make getting credit very challenging.

However, there are many strategies to improve your credit score and accomplish your goals. The following are some helpful tips to improve your credit score for a loan.

1. Use Your Credit Card Wisely

Use your credit cards up to the credit limit only. The card’s limit shouldn’t be increased frequently. Rather than upping the limit, pay your bills on time. Personal loans help you build your credit score. Because it is an unsecured loan, it lowers your credit score.

2. Make every EMI Payments Ontime

The inability to pay bills on time, difficult financial conditions, and excessive spending are some of the key factors that lower credit scores. Additionally, because of the negative credit record, credit scores are falling. A bank may reject a person who applies for a loan with a poor credit rating. Try to make early EMI payments to raise your credit score. You may also speak with an alliance company for simple repayment choices.

3. Credit Hungry Behavior – Don’t Apply for too many Loans

Your Credit score will decrease if you make too many credit report inquiries, bad payment history, too many credit card applications, or loan applications in a short period. If you plan to buy a loan, be sure you haven’t applied for any other types of credit in the three months before your loan purchase, such as a personal loan or a car loan. By doing this, you’ll be able to boost your eligibility, which will also help to improve your credit score and make it simpler to receive the loan you need.

Also Read: Reasons to Stop Using Credit Cards to Save Your Hard Earned Money

4. Maintain Your all Bank Accounts (Minimum Balance)

If you have too many unmaintained bank accounts, your credit score may decrease. For example, if you have four or five different savings accounts but none of them has the needed minimum balance, your credit score may suffer. Even yet, it unmistakably identifies every element that decreased your credit score. Maintaining a bank account would therefore enable you to improve your credit score.

5. Regularly Check Your Credit Report for New Entries

Regularly checking your credit score is a smart idea. Verify that information such as loan closing and other updates are accurate. Some banks neglect to update the agency, which may cause errors to appear on your report and affect your score. Raise the issue with the bank and resolve it right away to resolve problems like these.

A CIBIL score of 700 or more is considered good for getting your loan application if you intend to take out a personal or house loan.

You won’t be eligible for a low interest loan from any bank if your credit score is under 700, Following the above five suggestions you can easily improve your credit score for loans, you’ll notice a difference in your score within a few months.