How to Invest Money Wisely for Short Term Low Risk Returns: Learn how to set clear financial goals, diversify your investment portfolio wisely, leverage technological resources for efficient investing, and minimize costs while maximizing returns. Seek professional advice, embrace online brokerage platforms, and use financial apps for smarter financial management. Explore frequently asked questions for valuable insights into quick returns, minimizing costs, seeking professional advice, portfolio reviews, and potential risks. Empower your financial journey and make informed decisions with our expert guidance.

Set Clear and Specific Financial Goals

- Define short-term, medium-term, and long-term objectives.

- Determine the timeline and amount needed for each goal.

- Factor in risk tolerance and liquidity needs.

Check Your Current Financial Status

- Evaluate your current financial situation.

- Analyze your income, expenses, assets, and liabilities.

- Consider your cash flow and investment timeframe.

Also Check: 5 Best Investment Recommended for Females in India

Seek Professional Advice if Required

- Consult a financial advisor for personalized guidance.

- Explore investment options tailored to your goals and risk profile.

- Educate yourself on different investment strategies and products.

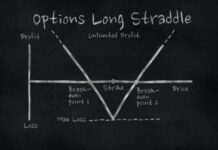

Diversify Your Investment Portfolio

Spread Your Investments Across Different Asset Classes (Majorly in Top/Bluechip Stocks)

- Allocate funds to stocks, bonds, real estate, and other investment vehicles.

- Reduce risk and enhance returns through diversification.

- Rebalance your portfolio regularly to maintain the desired asset allocation.

Don’t Put All Money at One Place – Consider Alternative Investment Opportunities

- Explore crowdfunding, peer-to-peer lending, and other non-traditional options.

- Invest in precious metals, cryptocurrencies, or collectibles for potential higher returns.

- Evaluate the liquidity and risk associated with alternative investments.

Monitor Market Trends and Economic Conditions of the Country

- Stay informed about global economic conditions and market developments.

- Follow industry news and expert analysis on investment opportunities.

- Adjust your investment strategy based on changing market dynamics.

Leverage Technological Resources for Efficient Investing

Always Use Online Brokerage Platforms App/Website for Easy Access to Financial Markets

- Open a brokerage account with a reputable online platform.

- Trade stocks, ETFs, and mutual funds with low fees and commissions.

- Utilize research tools and educational resources provided by online brokers.

Embrace Financial Apps for Budgeting and Tracking Investment Performance

- Download budgeting apps to monitor your income and expenses.

- Use investment tracking apps to analyze your portfolio performance and returns.

- Set up alerts and notifications for market updates and investment opportunities.

Minimize Costs and Maximize Returns

Opt for Low-Cost Index Funds and ETFs

- Invest in passively managed funds to minimize expenses and boost returns.

- Compare expense ratios and management fees of different funds before investing.

- Consider tax implications and diversification benefits of index funds.

Avoid Frequent Trading and Market Timing

- Resist the urge to buy and sell investments based on short-term market fluctuations.

- Embrace a long-term investment approach and focus on fundamentals.

- Calculate the impact of trading costs and taxes on your investment returns.