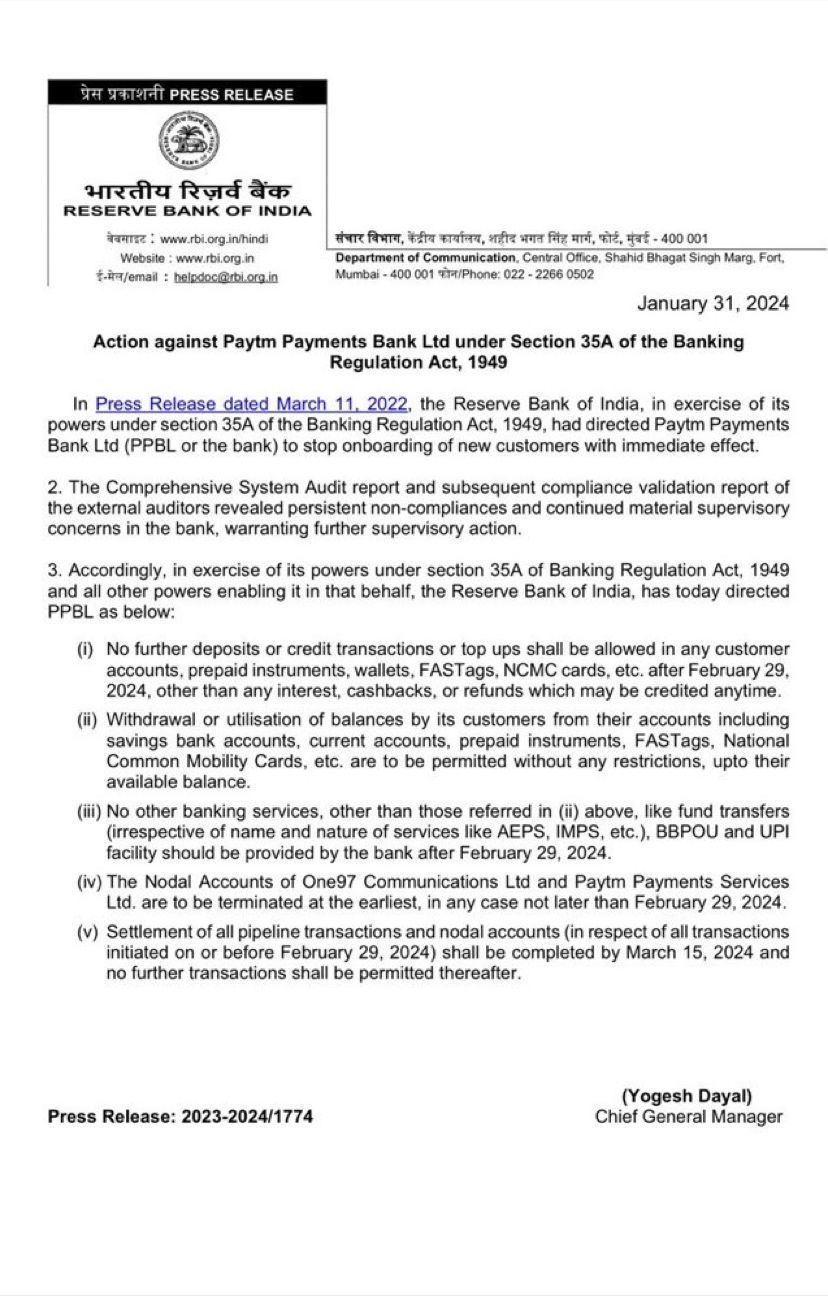

The recent imposition of limitations on Paytm Payments Bank by the Reserve Bank of India (RBI) has sent shockwaves through the fintech sector, prompting reflections on its potential impact. This crisis underscores the importance for all fintech players to prioritize regulatory adherence, with potential outcomes and lessons for finance professionals and industry participants.

Key Outcomes:

- Market Confidence Erosion:

- The crisis has eroded market and investor confidence in fintech.

- Investors and consumers are likely to become more cautious, scrutinizing financial health and regulatory compliance.

- Fundraising efforts for both existing and upcoming players may be impacted.

- Increased Regulatory Scrutiny:

- Regulators may intensify scrutiny on fintech companies, enforcing stricter monitoring.

- This focus on compliance may impact innovation and growth.

- Reevaluation of Investor Techniques:

- Investors are expected to reevaluate their strategies, emphasizing comprehensive due diligence, financial reporting, and an improved understanding of business models.

Also Check: 5 Smart Tips to Improve Your Credit Score for Loan

Considerations for Finance Professionals:

- Regular Monitoring of RBI Guidelines:

- Regularly monitor RBI guidelines and compliance requirements to ensure adherence to existing regulations and stay abreast of evolving norms.

- Prioritizing Data Security and Privacy:

- Prioritize robust data protection measures to maintain consumer trust.

- Strengthening Risk Management Protocols:

- Focus on identifying and mitigating potential risks, including operational, financial, or regulatory challenges.

- Impact of Crackdown on Non-Compliance:

- Be mindful of the impact of crackdowns on non-compliance on investor confidence and adjust fundraising strategies accordingly.

- VC and Investor Monitoring:

- Venture capitalists and equity investors should closely monitor and evaluate corporate governance practices, financial reporting transparency, and adherence to ethical standards when making funding decisions.

Lessons for Fintech Companies:

- Compliance First:

- Establish a robust governance framework with top-priority given to compliance.

- Sustainable Growth Models:

- Focus on sustainable and responsible growth models that prioritize customer value and long-term viability over aggressive expansion.

- Continuous Regulatory Engagement:

- Engage with regulators proactively, viewing them as partners in growth. Regular communication and adherence to regulatory guidelines are paramount.

Conclusion: While acknowledging the crisis’s impact, it’s essential to recognize the significant contributions Paytm has made to Digital India. Fintech players can learn from this experience, emphasizing compliance, sustainable growth, and continuous regulatory engagement to ensure the sector’s resilience and long-term success. As Paytm navigates these challenges, there’s confidence in its ability to emerge stronger from this experience.