Why do many options trading strategies not work as expected? Option trading in India is rising day by day and from the many financial stats globally almost 75% of option trading is done in India only (higher than USA and UK), which is a huge number for a developing country like India. Most people think that they can make money easily in a quick time with minimal trading capital in Option trading but the real scenario is reversed as most of them end up losing their capital and as per the SEBI, 9 out of 10 traders in India incurred the net losses in Future and options trading.

So, the question is why do most of the options trading strategies not work as expected and won’t help you to make money in real cases?

Options is a hedging instruments for most of the positional traders to protect their investments as they uses it as insurance premium in case of any heavy losses. But as the time evolves and retailers traders increase in the derivative market most of the day traders started using options to place intraday trades in indices like Nifty and Banknifty to make quick money, which is not the real case.

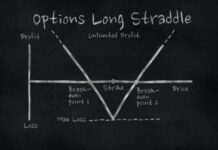

Also check: How to Use Straddle Options Trading Strategy?

As, per the many option trading experts and guru’s option trading is not just about strategies and technical chart analysis it’s all about the trader psychology with money and discipline in trading. Only those are able to make money in options trading who combines both strategies and psychology with discipline are able to make profits in option trading. The traders who are ready to accepts losses also and trade with strict Risk and Reward ration becomes profitable option trader in long run.